|

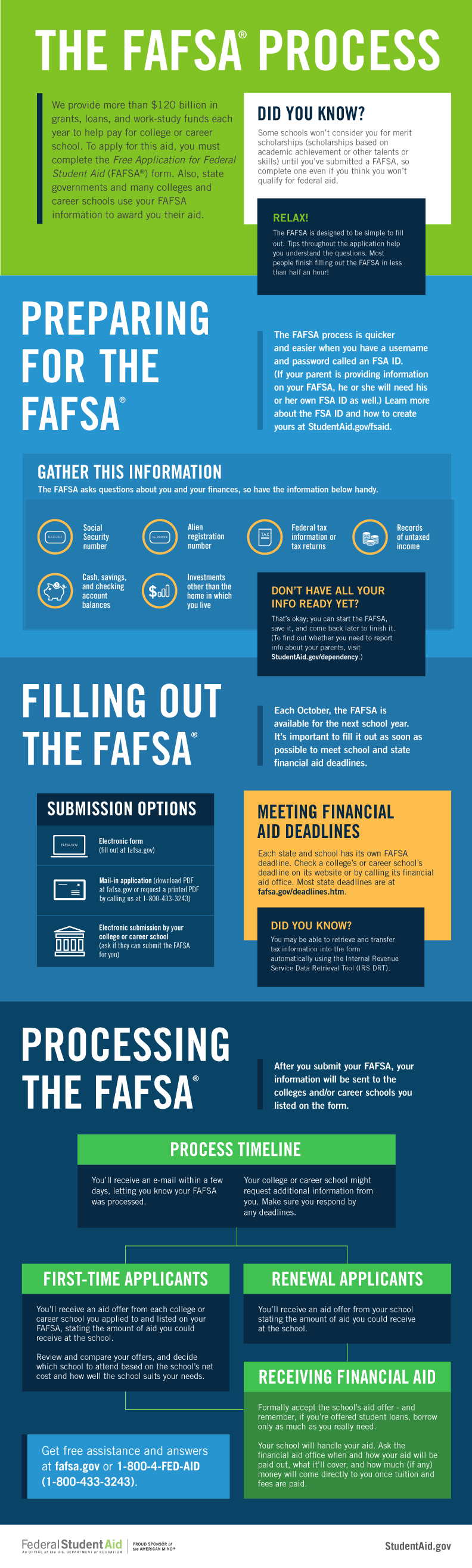

The most important financial aid form is the Free Application for Federal Student Aid (FAFSA). It is best to fill out this form as soon as possible after October 1st of your senior year. We recommend having it submitted by mid-November but the deadline for most colleges is March 2nd. If your parents’ tax returns are not finalized by that date, they must use estimates rather than miss the deadline. There is time to file an amendment if the estimates are way off – just don’t miss that deadline.

The FAFSA is automatically reviewed for grants, loans and work study.

Note: If you list a California college on your FAFSA form, then you will automatically be considered for a Cal Grant, which is state-funded money which is not repaid. However, in order to be considered, you must complete and submit a GPA Verification Form no later than March 2. You can obtain this form from your counselor and it will be submitted electronically for a quicker response. Once you have filed your FAFSA form, it will be processed and a Student Aid Report (SAR) will be mailed to you. If there are corrections to be made, make them at once and return the form as instructed. Remember that accurate figures from completed income tax returns are necessary. A good website for tips on the FAFSA is CREDIBLE. Step by Step VIDEO on completing the FAFSA |